Solar in 2021

by Joel Zook, Energy Planner

2021 is going to be another exciting year for solar. It’s a big deal that federal tax credits have been extended, net-metering laws are in place for Iowa’s investor-owned utilities (Alliant Energy and MidAmerican Energy) that give long term peace of mind to solar owners, AND the state legislature is looking at renewing and extending the state solar tax credit. Meanwhile, installed prices continue their gradual year-over-year drops.

It’s always a great time to install solar and get started on producing your own energy to drop your electric bills. Read on for details on WHY it is important to act this year, to see basic FINANCIALS for a typical solar system, and HOW you can get started.

Tax Credits:

This is the big story this year. At the end of 2020 the omnibus spending bill included language to extend the solar tax credits for additional years. The federal solar tax credit was 26% of the total installed cost and was set to drop to 22% this year. Instead, the tax credit will remain at 26% for systems installed through the end of 2022. The credit will drop to 22% for 2023 before going away altogether for homeowners. (Note that the federal credit remains at 10% for farms and other businesses after 2023).

The Iowa state tax solar credit is currently set to equal half of the federal tax credit. The law in place was actually tied to the original phase out schedule, so absent any changes in the state legislature the credit will still be 11% of the total system cost. However, there is an introduced bill that would set the state tax credit at 15% of the total system cost through the end of 2030. This proposed bill decouples the state credit from the federal tax credit so would remain the same regardless of any changes or updates in Washington DC. Importantly, the proposed bill also addresses the shortage of funding dedicated to the state solar tax credit. Currently there is a cap of $5 million per year that can be awarded to solar owners and the waiting list is over 2 years long. The proposed bill would raise the cap to $10 million per year and give $7 million in additional one-time funding to pay off the backlog of solar tax credits from back in 2019 up to present. We are tracking this bill, if you sign up for our newsletter we will let you know if there are important opportunities to make your support known.

Net-metering

Net-metering is now law. The new tariff looks a little different than the previous version but home and business owners are allowed to net-meter up to 110% of their annual energy usage. Sizing the system larger than your annual needs will result in the extra energy being forfeited to the utility, so it is important to size your solar to meet your needs and not any larger, unless you want to give away that energy for free.

The rules are not perfect and can be difficult for new construction or for customers looking to add electric load (like more electric cheating or EV charging, for example) to be able to net-meter 100% of their new, expected electric usage. Get in touch if you have questions about solar net-metering caps for your new home or building.

Price Dropping:

Several years ago, I began tracking the typical local installed cost of solar. We’re lucky in this corner of the state to have many competitive installers who know how to efficiently market and install solar and as a result we benefit from lower costs than most of the US, including larger metro areas even within Iowa. Today, an average sized residential solar array can be installed for less than $2.50 per watt. This is 40% less than systems installed as recently as 5 years ago. That’s an incredible drop in prices that also cuts the payback time of a system by 40%. Much of the cost declines have come from the drop in solar panel pricing, but the other materials have dropped some in price as well.

Another thing I’ll point out is that in addition to prices dropping, the systems have gotten better. New technology allows solar to be installed in areas of partial shading and microinverters or panel optimizers maximize every bit of sunshine that hits them. Most systems these days also come with panel-level monitoring, allowing owners and installers to track the production of each panel and troubleshoot far more quickly if anything ever goes amiss. Panels technology has also improved so more solar capacity is able to fit in smaller spaces, reducing both the amount of roof space needed but also the amount of non-panel equipment like racking and the time needed for installation.

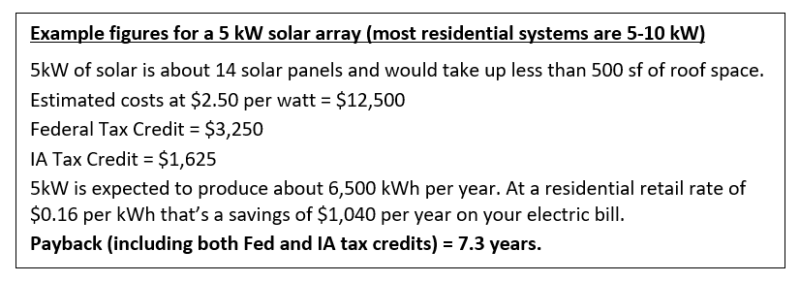

Example figures for a 5 kW solar array (most residential systems are 5-10 kW)

5kW of solar is about 15 solar panels and would take up less than 500 sf of roof space.

Estimated costs at $2.50 per watt = $12,500

Federal Tax Credit = $3,250

IA Tax Credit = $1,375 (Assuming a credit of 11% of system cost, could be better if solar bill passes)

5kW is expected to produce about 6,500 kWh per year. At a residential retail rate of $0.16 per kWh that’s a savings of $1,040 per year on your electric bill.

Payback (including both Fed and IA tax credits) = 7.6 years.

*Shading or roof orientation can affect payback.

**NOTE FOR FARMS/BUSINESSES: the economics are even better, in part because the larger systems have a lower per/watt installed price, but also because businesses can take depreciation. Taken together, simple paybacks for farms and businesses are often 5-6 years.

Act Now!

So do it now, get started on your solar system today by calling a local installer or getting a solar site assessment from us at the Energy District. If you have a shade free roof or an open spot for a ground mounted system, the financial payback of solar should be well under 10 years. This for a system that is typically warrantied for 25 years. I recommend that you consider solar even if you have a marginal site, or have looked in the past and it didn’t work. My personal recommendation is not to wait just because the tax credits will be the same next year as they are now. Get on an installers list, they are busy! And don’t wait to start making your own energy, electric prices aren’t getting any lower!

Where to Start:

Solar installers are happy to give free estimates that include basic production figures and payback times. Shop Local! We’re fortunate to have a number of high quality solar installers in the area. Many are Energy District member-sponsors, and you can find them on our webpage. Or, call your electrician and ask them about solar.

If you’d like a look at the payback of a solar system for your home or business from someone not selling you solar panels, give the Energy District a call. I (Joel Zook) can provide a simple estimate of prices, shading analysis and an estimate on energy produced. I charge $200 for a solar site assessment, plus a travel fee for locations outside of Winneshiek County. A solar assessment from the Energy District will give you excellent background knowledge about solar and a critical look at the estimated energy production, tax incentives and payback. Give me a call if you’d like to learn more. You can reach me at joel@energydistrict.org or 563-380-7137.