2020: Shining Bright

Joel Zook, Energy Planner, Winneshiek Energy District

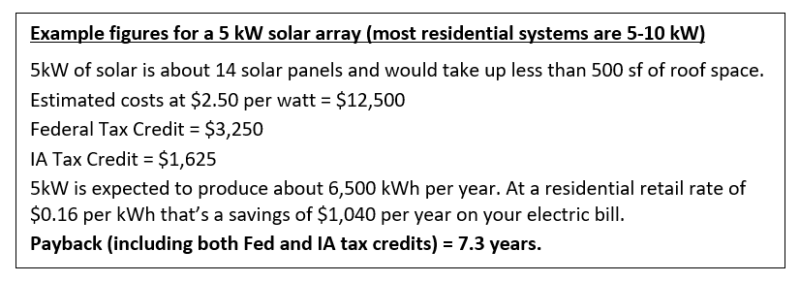

Last year, I finally put solar on my roof. 2019 was the year many people, including myself, took advantage of state and federal tax credits before they phase out over three years. If you are thinking about solar, it’s important to know that tax credits are still in place, but drop a bit lower at the end of 2020, before phasing out completely in 2021. If you were ever going to install solar, you should make it happen this year. Read on for details on WHY it is important to act this year, to see basic FINANCIALS for a typical solar system, and HOW you can get started.

Price dropping

Solar can now be installed for almost half the price it was installed only 5 or six years ago. That’s an incredible drop in prices that also cuts the payback time to less than 10 years for most residential systems. Much of the cost declines have come from the drop in solar panel pricing, but the other materials have dropped some in price as well. Additionally, those of us in northeast Iowa have benefited from having a number of available and well-qualified installers that have gained experience as they’ve installed hundreds of solar systems over the past few years.

Another thing I’ll point out is that in addition to prices dropping, the systems have gotten better. New technology allows solar to be installed in areas of partial shading and microinverters or panel optimizers maximize every bit of sunshine that hits them. Most systems these days also come with panel-level monitoring, allowing owners and installers to track the production of each panel and troubleshoot far more quickly if anything ever goes amiss.

A quick aside for those worrying about the upfront cost, solar might cost less than you think. Many people install systems set to meet 100% of their annual energy usage, but there’s no rule that says that needs to be the case. A “full sized” solar system may cost less than you think. But it’s also fine to install a slightly smaller array – sized to meet your budget. Additionally, local banks are often willing to finance a solar loan. Decorah Bank and Trust has financed over 100 solar projects over the past 10 years. For systems with little to no shade, the savings from solar on your electric bill can often be greater than the principal and interest payments on a 10-year loan.

Tax Credits

The huge motivation in getting the project done this year is the phase out of the federal solar tax credits. They are currently 26% of the total cost of the system, if installed in 2020. The federal tax credit drops to 22% in 2021 before going away altogether for homeowners. (Note that the federal credit remains at 10% for farms and other businesses after 2021). The Iowa state tax credit is set to equal half of the federal tax credit and will decline and end on the same schedule as the federal tax credit. This year the Iowa tax credit is worth 13% of the cost of the system but it be worth only 11% next year.

One common question I get is whether solar will continue to drop in price. I expect that solar prices will continue to drop some, but we are reaching a leveling out point where prices are not dropping as fast as they were. It would surprise me if price drops continue at a pace fast enough to exceed the combined benefit declines of the state and federal credits.

Net-metering

It appears that some version of net-metering is around to stay. Last year a proposed bill by MidAmerican Energy would have ended net-metering as we know it. Fortunately, the bill was stopped in the Iowa legislature. It appears that a deal is being worked out this legislative session that would leave net-metering in place for several years.

The important thing to note is that all past proposals to change net-metering have allowed existing customers to stay with the solar policy they had at the time of their installation. This means customers are locked in to the policies they sign up with. Getting solar installed now is a good way to make sure you have access to net-metering for the lifetime of your solar investment.

Act now

So do it now, 2020 is another year for solar. If you have a shade-free roof or an open spot for a ground-mounted system, the financial payback of solar should be well under 10 years. This for a system that is typically warrantied for 25 years. I recommend that you consider solar even if you have a marginal site or have looked in the past and it didn’t work. Prices have dropped so far from a number of years ago, it’s certainly worth another look.

*Shading or roof orientation can affect payback.

**NOTE FOR FARMS/BUSINESSES: the economics are even better, in part because the larger systems have a lower per/watt installed price, but also because businesses can take depreciation. Taken together, simple paybacks for farms and businesses are often 5-6 years.

Where to start

Solar installers are happy to give free estimates that include basic production figures and payback times. Shop Local! We’re fortunate to have a number of high-quality solar installers in the area. Many are Energy District member-sponsors, and you can find them on our webpage. Or, call your electrician and ask them about solar.

If you’d like a look at the payback of a solar system for your home or business from someone not selling you solar panels, give the Energy District a call. I can provide a simple estimate of prices, shading analysis and an estimate on energy produced. I charge $200 for a solar site assessment, plus a travel fee for sites outside of Winneshiek County. A solar assessment from the Energy District will give you excellent background knowledge about solar and a critical look at the estimated energy production, tax incentives and payback. Give me a call if you’d like to learn more. You can reach me at joel@energydistrict.org or 563-380-7137.

P.S. – Geothermal Tax Credits expire on the same schedule as solar. If you’re thinking of installing a geothermal system – talk to a heating contractor soon!